The Blockchain Space in Africa - Part 1

Blockchain is the new cool thing globally but what's actually going on in Africa? I look at African startups that are building the future riding on blockchain tech. From remittances, exchanges to DeFi

Introduction

On 31 October 2008, Satoshi Nakamoto published a whitepaper entitled "Bitcoin: A Peer-to-Peer Electronic Cash System". You can find it here. Let me highlight a few lines that may spark your curiosity if you are new in this space ;

Commerce on the Internet has come to rely almost exclusively on financial institutions serving as trusted third parties to process electronic payments. While the system works well enough for most transactions, it still suffers from the inherent weaknesses of the trust-based model. A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution. Digital signatures provide part of the solution (avoiding a trusted intermediary ).

What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party. Transactions that are computationally impractical to reverse would protect sellers from fraud, and routine escrow mechanisms could easily be implemented to protect buyers.

You might want to underline the keywords; peer-to-peer, trustless, digital signatures, decentralization & cryptography. Look them up and you might start to understand blockchain from a first-principles approach. If the bitcoin whitepaper is kind of too much for you, I suggest starting here.

The Blockchain Space in Africa

The blockchain space is growing globally and most importantly in Africa. There are numerous applications of the technology in our African market. I dive deep into the companies that are shaping the space. This includes applicable industries, funding reports, and traction data that these companies are getting. Data should always guide our opinions not the other way round. Data-driven intelligence.

Industries / Categories

Remittances

Peer-to-peer Payments

Crypto Exchanges

DeFi

Altcoins e.t.c

Remittances & P2P Payments

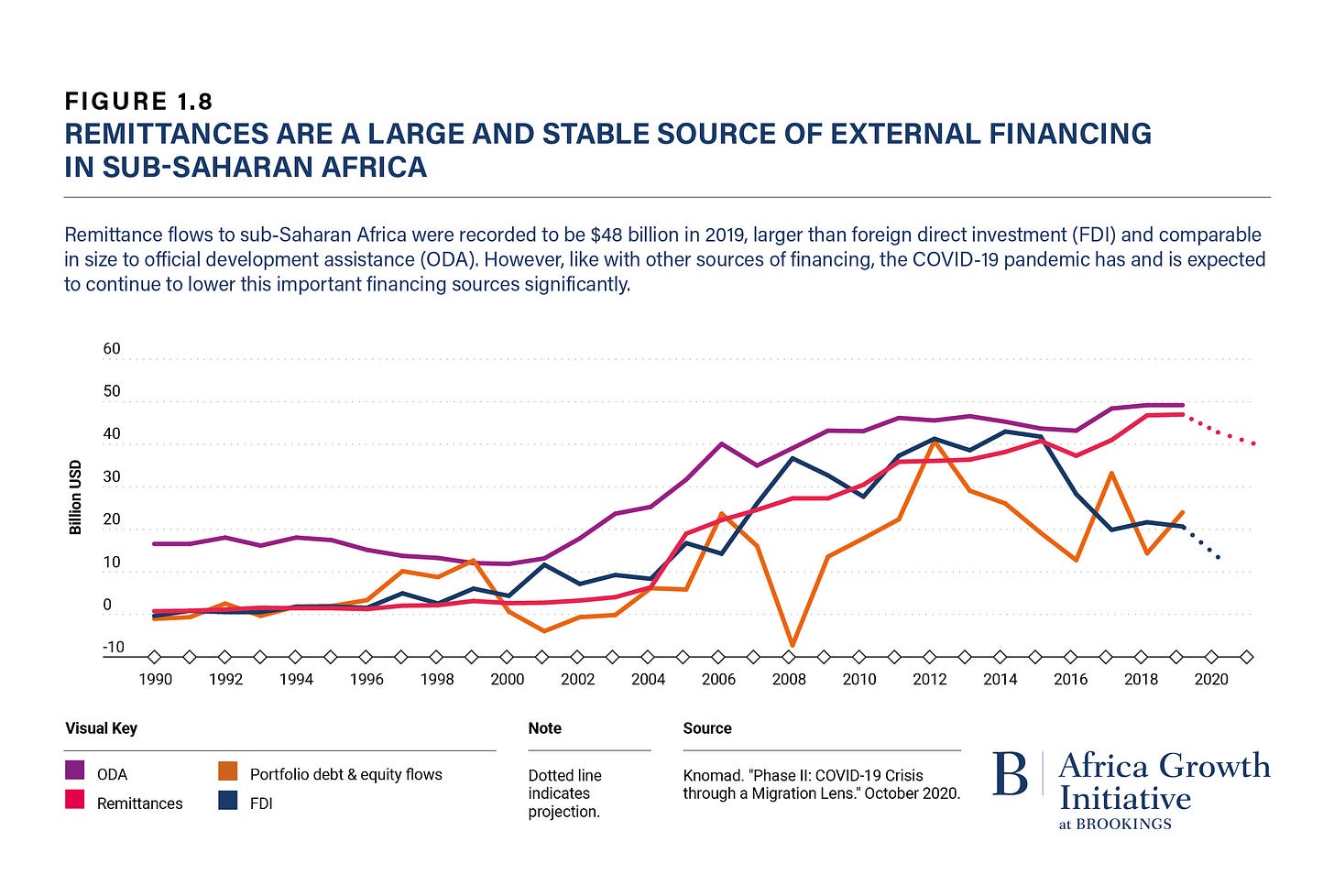

Remittances to Africa are bigger than FDI & Portfolio and debt-equity flows. They are catching up with Official Development Assistance - Donor Funds. Take a look at the Brookings Africa Growth Initiative research below;

Africans in the diaspora send around $48 billion a year.

What does this have to do with crypto/blockchain? Because there are huge costs of sending fiat money. If the transaction costs can be cut, millions will be saved every year. Blockchain-based remittance costs are lower than fiat. Remember the Satoshi quotes above on transaction costs? No middleman/intermediaries, no exchange rate costs, and extra charges.

Take a look at the year 2020 World Bank graph showing average remittance costs in Africa being the highest on this planet. Link

Remittance costs in Africa are 8.02%.

These are averages. Certain countries are higher than the 8.02% highlighted here. With a young population that is moving into the diaspora for greener pastures, the total amount of remittances is going to grow and millions in transaction costs will be saved if better technologies are applied.

Take a look at this visualization as per the OECD Blockchain Primer.

The international bank transfer option is screaming FEES! FEES! FEES! FEES !

Remittances1

Remittances is a field to ride on the blockchain now which is why cool investors such as Softbank, Y Combinator, and Future Africa have taken notice and invested in a 2-year-old startup called Afriex. The benefits of using crypto vs traditional methods are huge. Here is a comparison of Afriex vs Western Union as per this Afriex blog

You can note, traditional remittance providers, make a profit on exchange rates on top of the sending fee that they charge (hidden fees).

Blockchain startups are offering instant transactions, low fees & favourible exchange rates

Payments

Bundle Africa, a Binance Labs incubatee, and Centbee have developed social apps that allow people to store, spend and send crypto & cash. Centbee has also developed a blockchain-based remittance product called Minit Money that allows people to send money from South Africa to other countries.

Kotani Pay built blockchain infrastructure to allow blockchain fintechs to integrate seamlessly with local payment channels across Africa. It enables businesses to process stablecoins payments to SMS phone users in Africa.

Crypto Exchanges

Crypto exchanges are online markets where people can buy or sell cryptocurrencies. These are some of the top African cryptocurrency exchanges. South Africa and Nigeria lead this space.

This is an interesting area that has seen investments flowing in from top investors. Alameda research the developers behind the crypto behemoth FTX invested in Ovex a South African crypto exchange. Andreessen Horowitz invested in Yellowcard which has raised the most funding in African crypto exchanges. Naspers invested and exited in Luno which is one of the pioneers in crypto having been founded in 2013.

The Blockchain Space in Africa - Part 2

In the next chapter, I look into more African blockchain startups including those focusing on Decentralised Finance ( DeFi).

Wrapping it up.

I’m glad you made it to the end.

One more thing. Please follow Africaintell Twitter. DMs are open to share your views, input or suggestions.

I like Gifs and memes. If you have better ones, please lemme know.Data presented in this article has been collected from publicly available sources and credible African startup media such as Disrupt Africa, Techpoint, Tech Cabal, Tech Crunch & Ventureburn. Here is a google sheet with the data used in this article.

The list of startups presented here is not exhaustive. If I missed an awesome company, please DM the details.

You may find that some startups here have UK/US offices. I have included under African startups those companies that were founded to tackle the African market.